In Westport, Mass., about 60 miles southwest of Boston, traffic crawls along Route 6 as drivers make their way to the nearby Atlantic beaches like Horseneck or Baker's. A 10-worker crew pouring and raking asphalt onto the road slows their progress. It's the kind of small annoyance drivers nationwide face each summer. It's also one small manifestation of President Barack Obama's ambitious strategy for jump-starting the economy.

In April, the P.J. Keating Co., a construction firm based in Lunenburg, Mass., bid on about a dozen stimulus projects funded through the U.S. Transportation Department. It won two contracts, including this $4.06 million job, rescuing what would have been a dismal year for P.J. Keating, says David Baker, 36, a manager of construction operations. As business dwindled over the past two years, the firm laid off about a dozen people. "We definitely would have been faced with another half-dozen layoffs had we not gotten these stimulus projects," Baker says. Instead, the company kept all its remaining 300 employees and hired five new ones. Ordinarily, a few government-funded jobs, like traffic on Route 6, wouldn't be noteworthy. But the tableau neatly encapsulates the promise—and pitfalls—of an economy at an inflection point.

The Great Recession, which rolled over our financial lives like one of P.J. Keating's giant pavers, is most likely over. Home sales, while still far below the levels of a year ago, have risen for three straight months—a first since 2004. The stock market has rallied 44 percent since March, thanks to renewed optimism and improving earnings from big companies like Goldman Sachs and Apple. In June, seven of the 10 indicators in the Conference Board Leading Economic Index pointed upward, including manufacturing hours worked and unemployment claims. Macroeconomic Advisers, the St. Louis-based consulting firm, says the economy is expanding at a 2.5 percent annual rate in the current quarter. Economic activity "will increase slightly over the remainder of 2009," Federal Reserve Chairman Ben Bernanke told Congress.

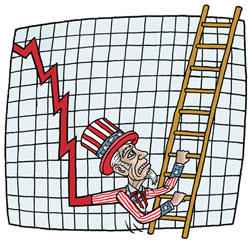

Irrational exuberance it's not. But even stagnation would be an improvement over recent history. The U.S. economy shrank at nearly a 6 percent annualized rate between September 2008 and March 2009, a shocking slowdown that pitched the global economy into recession for the first time since World War II. "This looks an awful lot like the beginning of a second Great Depression," Nobel laureate Paul Krugman said in January. Catastrophe may have been averted. But when economists proclaim a recession over, they're celebrating a technicality: They mean economic output has stopped contracting. And while that is good news, you might wait a while before adding Judy Garland's rendition of "Happy Days Are Here Again" to your iPod. GDP growth alone can't feed a family or pay a mortgage. Cursed with a high national debt load and blessed with a dynamic, growing work force, the U.S. economy needs annual growth of at least 1.5 percent just to feel like we're standing still.

Worse, the data point that means the most to our psychological well-being—unemployment—is likely to keep climbing. The loss of 6.5 million jobs since December 2007 has spurred the sharpest rise in the unemployment rate since the 1930s. As manufacturing jobs move overseas and companies struggle to further reduce costs, unemployment—which stands at 9.5 percent—is likely to rise above 10 percent. "There's a difference between having an expansion and an economy that has recovered," says Lawrence Summers, Obama's chief economic adviser.

Having survived a near-death economic experience, Americans now need to focus on surviving what's likely to be a pokey, painful recovery. "I see 1 percent growth in the economy in the next few years," says New York University economist Nouriel Roubini. "It's going to feel like a recession, even when it ends." Shifting our unwieldy $14 trillion economy from rapid reverse into neutral took heroic efforts from the Federal Reserve, the Treasury Department (in two administrations), two sessions of Congress, and, of course, the taxpayers. But the greater challenge may be getting the economy to start growing at a pace that creates jobs, boosts incomes, and raises corporate profits—all without triggering inflation.

A year ago, I dubbed this a new kind of recession—one caused by turmoil in housing and finance rather than manufacturing or weak consumer spending. Now that it's over, we'll need a new kind of recovery. For 60 years, policymakers have relied on a series of simple tools for combating slowdowns and promoting growth: The Fed cuts interest rates, government slashes taxes, and a deregulated Wall Street provides easy money. All of which spurs debt-fueled consumption and the movement of goods and services around the globe.

No more. The Fed literally can't cut interest rates further—the overnight interest rate it controls is at zero. Given the deficits and Democratic control of Washington, the prospect of broad-based tax cuts are slim. Americans are still stuffing cash under the mattress. "The last several recoveries were not sustained because they were based on bubbles, they were led by consumption, and they enhanced inequality," says Summers. "The president's emphasis is on having a different kind of expansion."

There is more..

READ MORE+

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment